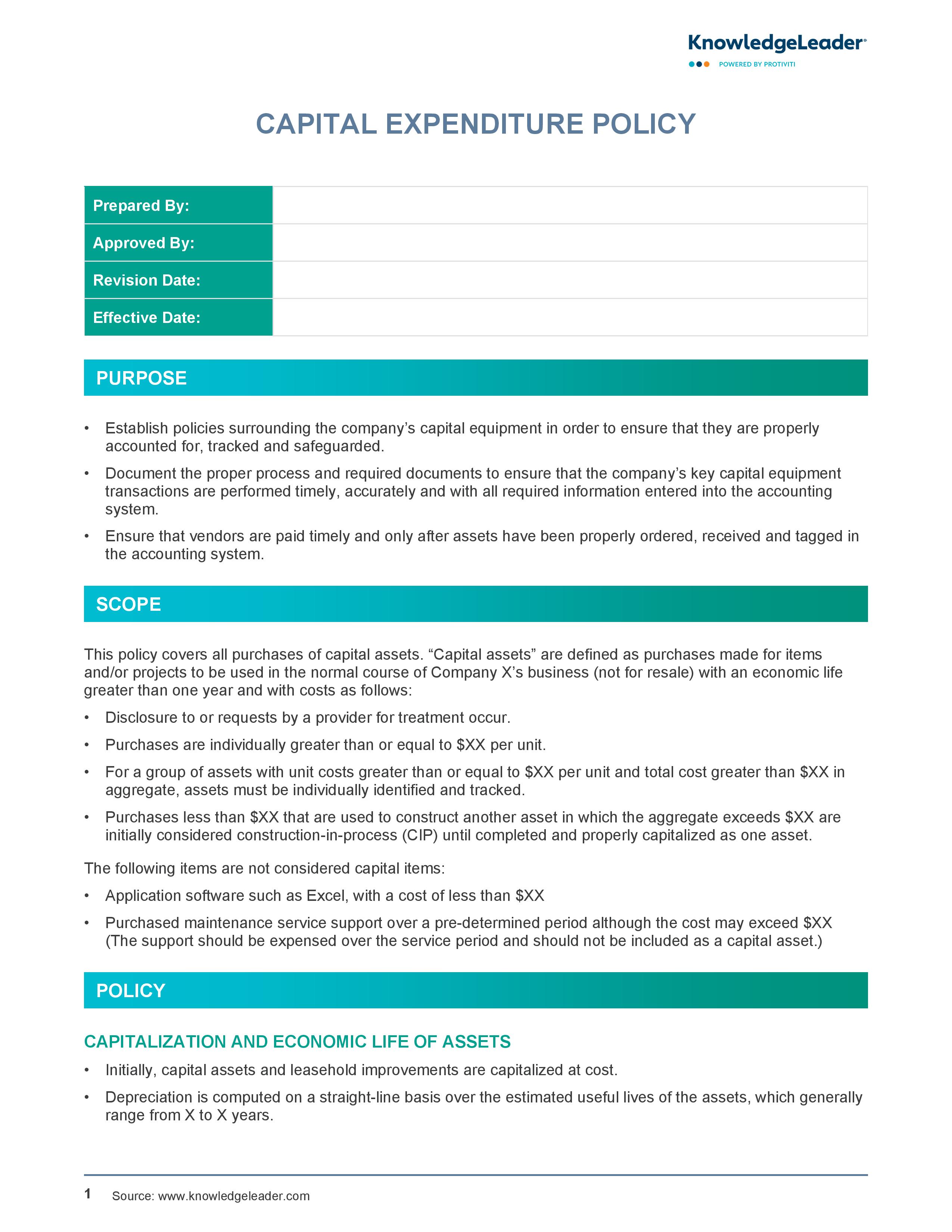

Capital Expenditure Policy

Subscriber Content

Understanding the Nuances of Capital Expenditure Procedures

Organizations can use this policy to ensure that their capital equipment is properly accounted for, tracked and safeguarded.

This policy can also be used to document the proper process and required documents to ensure that the company’s key capital equipment transactions are performed timely, accurately and with all required information entered into the accounting system and ensure that vendors are paid timely and only after assets have been properly ordered, received and tagged in the accounting system. Depreciation is computed on a straight-line basis over the estimated useful lives of the assets, which generally range from X to X years.