Investment Income Policy

Investment Income Policy: Establishing Procedures for Recording Revenue

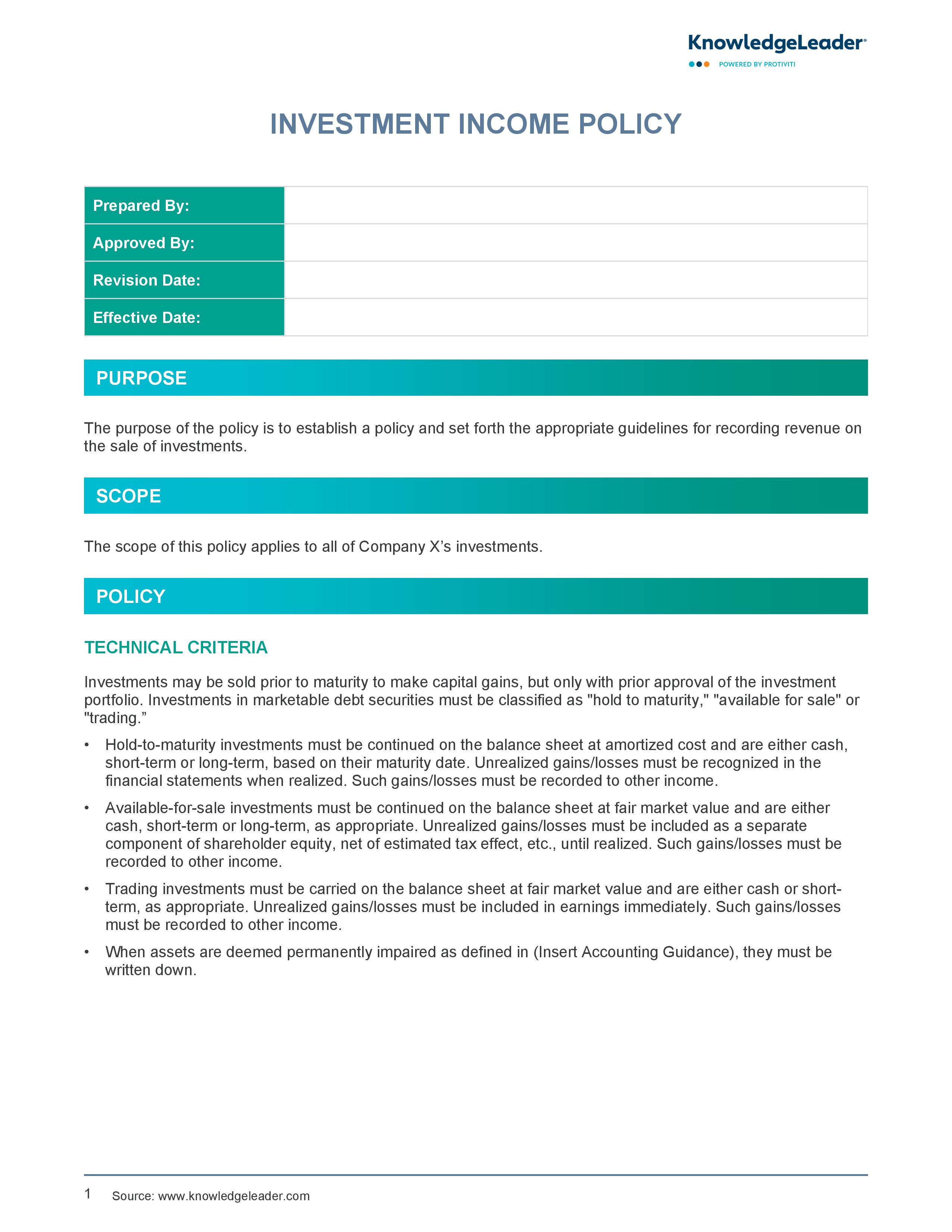

This Investment Income Policy sets forth the appropriate guidelines for recording revenue on the sale of investments.

Under this policy, investments may be sold prior to maturity to make capital gains, but only with approval of the investment portfolio. Investments in marketable debt securities must be classified as "hold to maturity," "available for sale" or "trading.” Trading investments must be carried on the balance sheet at fair market value and are either cash or short-term, as appropriate. Unrealized gains/losses must be included in earnings immediately. Such gains/losses must be recorded to other income.